Introduction

- Why ASICs Matter

Define ASICs vs. general-purpose chips and FPGAs Emphasize their tailored efficiency, power savings, and cost-per-function benefits in high-volume production. - Current Landscape

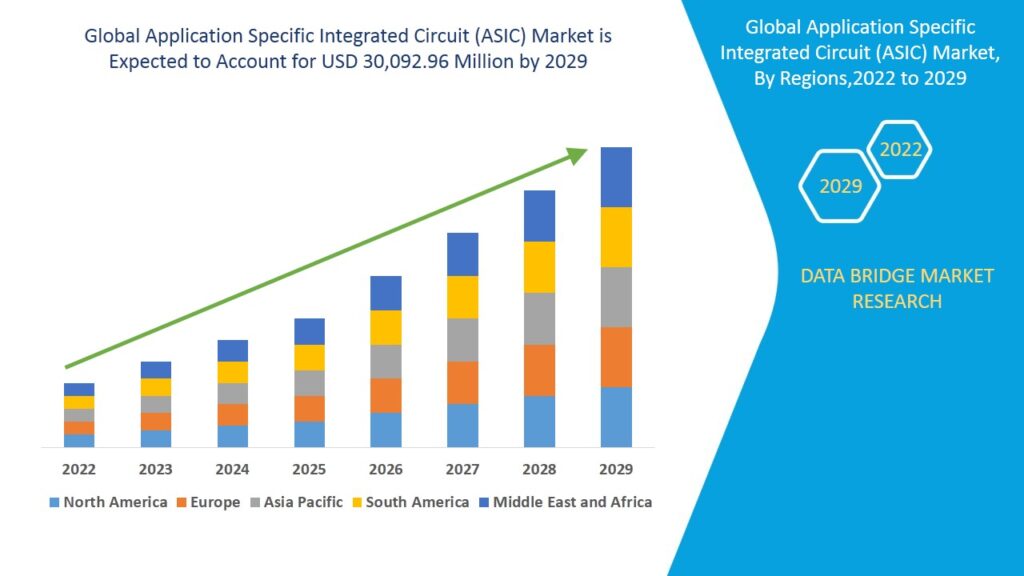

Global ASIC market reaching ~$17–18 billion in 2023–24 and projected to reach $25–35 billion by 2030–32, growing at ~5–7 % CAGR .Source: https://www.databridgemarketresearch.com/reports/global-application-specific-integrated-circuit-asic-market

Market Size & Forecast

- Market Valuation

• USD 17.03 B in 2024

• USD 17.65 B in 2024 with CAGR 6.1 % till 2030

• USD 21.8 B in 2025, forecasted USD 35.7 B by 2032 (CAGR ~7.3 %) - Segment Projections

• Semi‑custom ASIC fastest-growing, dominant segment

• Programmable ASIC market ~$18.3 B in 2024 → ~$20.2 B in 2025, reaching $31.6 B by 2030 (CAGR ~9.3 %)

Regional Breakdown

- Asia Pacific

Dominant region with ~48 % share in 2025 and fastest CAGR (~9.7 %)

China likely to lead in revenue by 2030; India fastest‑growing (~$1.2 B by 2030) - North America

~25–36 % share, driven by AI, telecom, automotive, data centers, and government CHIPS initiatives - Europe, Latin America, MEA

Moderate but rising presence due to industrial automation, 5G rollouts, and tech investments

End‑User Applications

- Consumer Electronics

Smartphones, wearables, TV, gaming—major use of ASIC for low power and miniaturization - Telecommunications & 5G

ASIC demand surging for base stations, Massive MIMO, Open RAN, edge compute - Automotive & EV/ADAS

ASIC use in sensors, ADAS, autonomous driving, EV powertrains - Industrial/IoT

Edge compute, smart utilities, automation—benefiting from low-power, custom ASICs - Data Centers & AI

Hyperscalers (Google, Amazon, Microsoft) launching their own AI ASICs to reduce Nvidia dependency; projected 50 % CAGR in ASIC purchases - Cryptocurrency Mining

Specialized mining ASICs fuelled by high efficiency demands

Market Drivers

- AI/ML Acceleration

Enterprises and cloud providers are migrating to custom acceleration ASICs for performance and control (e.g., internal Graviton, in‑house AI chips) - 5G & Edge Compute

Massive deployment creating demand for telecom ASICs - IoT and Consumer Demand

Explosion in connected devices; ASICs help miniaturize and optimize power - Automotive Electrification

EVs and autonomous vehicles require custom ASICs for sensor and power tasks - Government Support

CHIPS Act and India’s PLI scheme encourage domestic semiconductor innovation

Challenges & Restraints

- High NRE Costs & Design Complexity

ASICs can cost millions to develop; FPGAs still favorable for low-volume runs - Long Development Lead Times

Mask-set delays and slow prototyping hinder fast time-to-market - Yield and Supply Chain Risks

Variability in fabrication reduces yield; global disruptions remain a concern - Technical Obsolescence

Rapid node shrinking (5 nm, 3 nm) requires continual investment - Regulatory & Talent Constraints

Complexity in certification processes and talent shortages

Technological Trends & Innovations

- Advanced Process Nodes

Move toward 5 nm and 3 nm, enabling SoC-scale integration - Heterogeneous Integration

CPU, GPU, FPGA, and ASIC on one die for performance and energy gain - AI‑assisted Design Tools

Use of LLMs in ASIC flows streamlining RTL-to-GDSII (e.g., AiEDA platform) - Structured ASICs

Hybrid between FPGA and ASIC for reduced NRE/time-to-market - Security‑Focused ASICs

ASICs built-in for secure comms and cryptographic resilience - 3D‑stacking & Chiplets

Enhanced performance through component stacking and modular design

Competitive Landscape

- Legacy Semiconductor Giants

Broadcom, Qualcomm, Intel, Texas Instruments, Infineon, STMicro, Fujitsu - Fabless & Foundries

TSMC leads fabrication; Alchip, Faraday supply custom ASICs; Nvidia enabling NVLink ecosystem - Hyperscalers (In‑house)

AWS Graviton, Google, Microsoft, Amazon building AI/telecom ASICs to reduce third-party reliance - Startups & Specialized Firms

Focus on crypto‑mining, IoT sensors, wearable solutions.

Investment & M&A Opportunities

- Growth Hotspots

Asia-Pacific (China, India), programmable/semi‑custom sectors, AI/automotive verticals - Policy Drivers

Incentives in the US and India underpin local ASIC ecosystem growth - M&A & Partnerships

Collaborations (e.g., Nvidia’s NVLink Fusion) accelerate ASIC integration - Investment Risks

Development costs, competition, tech obsolescence, geopolitical trade risks.

Future Outlook & Strategic Recommendations

- Market Trajectory

Expect global growth to $30–45 B by 2032, with Asia-Pacific dominance and increasing hyperscaler in‑house production - For Startups & Vendors

Target verticals (AI, telecom, automotive); invest in structured ASICs and AI‑design tools; localize manufacturing via regional incentives. - For Hyperscalers & Enterprises

Continue hybrid model of licensed GPU + custom ASICs; partner with leading foundries; adopt heterogeneous and secure-chip design. - For Policy Makers

Enable domestic fabs, IP toolchain investments, ESG standards, workforce training; streamline test-lab accreditations and visa frameworks.

Conclusion

The ASIC market is poised for dynamic growth driven by AI acceleration, 5G deployment, IoT proliferation, and electric/autonomous vehicles. Technological advances—like 5 nm-node chips, AI-enhanced design, and heterogeneous integration—promise enhanced performance but also demand increased investment. Regional policies, strategic partnerships, and security/eco-conscious design will shape competitive advantage. For new entrants and investors, the key lies in smart positioning within high-growth verticals, embracing modular design, and leveraging global fab ecosystems.

https://www.diigo.com/item/note/b0onl/eap2?k=8b387030f1fdc47a02f98fe3dbf96921

https://groups.google.com/g/marketresearch15/c/5jYqK3qYgD0

https://telegra.ph/Sequencing-Kits-Market-projected-to-reach-USD-1713-billion-by-2032-06-06

https://groups.google.com/g/marketresearch15/c/Luc4YfK5EZA

https://ayema.ng/blogs/211230/Server-Chassis-Market-expected-to-reach-USD-4-74-billion