Solana has emerged as one of the leading blockchain platforms, known for its high-speed transactions and low fees. One of the most critical metrics for analyzing the performance and popularity of Solana is its volume. Solana volume refers to the total value of transactions executed on the network within a given time frame. Understanding Solana volume is essential for traders, investors, and developers, as it provides insights into market activity, liquidity, and overall adoption.

What is Solana Volume?

Solana volume represents the total trading and transactional activity occurring on the Solana blockchain. This can be categorized into:

Trading Volume: The amount of Solana (SOL) traded on cryptocurrency exchanges.

On-Chain Transaction Volume: The total value of transactions processed within the Solana network.

Decentralized Finance (DeFi) Volume: The trading and swapping activity within Solana’s decentralized exchanges (DEXs) and liquidity pools.

NFT Market Volume: The total sales and trades of non-fungible tokens (NFTs) built on Solana.

Each of these categories provides valuable insights into Solana’s adoption and use cases, making volume an essential metric for market analysis.

Why is Solana Volume Important?

Solana volume is a crucial indicator for several reasons:

Market Liquidity

Higher trading volume indicates better liquidity, making it easier for investors to buy and sell assets without significantly impacting price movements.

Network Adoption

A consistently high transaction volume suggests increasing adoption of Solana’s blockchain, which can be a positive signal for long-term growth.

Price Trends and Market Sentiment

Analyzing volume alongside price movements helps traders identify trends. For example, rising prices with increasing volume indicate strong market confidence, while declining volume may signal weakening interest.

Institutional Interest

Large trading volumes can attract institutional investors looking for stable and liquid markets. Solana’s growing volume may indicate rising interest from major players in the crypto space.

DeFi and NFT Growth

Solana’s DeFi ecosystem and NFT marketplaces contribute significantly to its total volume. Monitoring volume in these sectors helps gauge the platform’s competitiveness against other blockchains like Ethereum and Binance Smart Chain.

Factors Affecting Solana Volume

Several factors influence the volume of transactions on the Solana network:

Market Conditions: Bullish markets generally see higher volumes as more investors participate, while bearish markets may result in reduced activity.

Network Efficiency: Solana’s high throughput and low transaction fees encourage greater use, driving up volume.

Adoption of dApps: Popular decentralized applications (dApps) on Solana, such as Serum and Raydium, contribute to increased trading volume.

Regulatory Environment: Regulatory developments can impact investor sentiment and, consequently, trading volume.

Competition: The performance of competing blockchains, such as Ethereum and Avalanche, can influence Solana’s transaction volume.

Security and Stability: Network outages or security concerns can lead to temporary drops in volume as users seek alternatives.

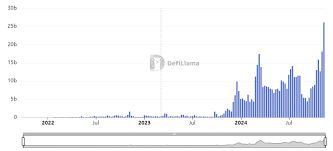

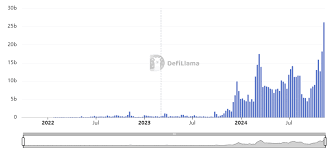

How to Track Solana Volume

Tracking Solana volume requires using various blockchain analytics platforms and cryptocurrency exchanges. Some of the best sources include:

CoinGecko and CoinMarketCap: Provide real-time data on Solana’s trading volume across multiple exchanges.

Solscan and Solana Explorer: Offer insights into on-chain transaction volume and activity.

Dune Analytics: Helps analyze DeFi and NFT volumes within the Solana ecosystem.

TradingView: Allows traders to visualize Solana volume alongside price charts for technical analysis.

Future Outlook of Solana Volume

As Solana continues to grow and evolve, its volume is expected to increase due to several key developments:

- Scalability Improvements: Ongoing network upgrades to enhance stability and performance will drive greater adoption.

- Institutional Adoption: More institutions entering the Solana ecosystem could lead to increased trading and transactional volumes.

- DeFi Expansion: The rise of innovative DeFi projects on Solana will contribute to higher transaction volumes.

- NFT Market Growth: More NFT projects and marketplaces built on Solana will further boost trading activity.

- Cross-Chain Integration: Improved interoperability with other blockchains can attract more users and drive higher volume.

Frequently Asked Questions (FAQs)

1. What is Solana’s daily transaction volume?

Solana’s daily transaction volume varies based on market conditions and adoption. You can check real-time data on platforms like CoinMarketCap or Solscan.

2. How does Solana volume compare to Ethereum?

Solana’s transaction volume is generally higher in terms of sheer transaction count due to its low fees and high speed, but Ethereum often leads in total trading value due to its larger market capitalization.

3. Why is Solana volume important for traders?

Solana volume helps traders assess market liquidity, identify trends, and make informed decisions about buying or selling SOL.

4. What causes a drop in Solana volume?

Factors such as market downturns, network outages, and reduced investor interest can lead to a drop in Solana volume.

5. How can I use Solana volume data for trading?

Traders use volume indicators to confirm trends, spot breakouts, and assess market sentiment. High volume with price increases often signals a strong uptrend.

Conclusion

Solana volume is a key metric that reflects the health and activity of the network. Whether you are a trader, investor, or developer, understanding Solana volume can provide valuable insights into the market dynamics of this rapidly growing blockchain. By keeping an eye on volume trends, Solana users can make informed decisions and better navigate the evolving cryptocurrency landscape.